The COVID-19 pandemic has impacted economies world-wide and exposed global economies to uncertainty or unprecedent consequences such as halt of business operations and disruption of cross-border supply-chain, thus causing adverse impacts to trade and investment, employment, economic growth.

In view of minimizing such adverse economic shocks by the COVID-19, the Bangladeshi government announced various supporting policy measures (fiscal and non-fiscal measures) while having put restrictive measures in place. BIDA as an apex IPA for Bangladesh also responded to the immediate impacts of the COVID-19 on private sector by proposing emergency measures and actions in view of ensuring the continuation of investors’ business during the pandemic.

Although the pandemic situation has been significantly eased in Bangladesh since August 2021, this section introduces both potential and existing investors with the information access to the COVID-19 monitor, updated restrictions in relation to the COVID-19, brief of economic and trade/ investment trends, remaining policy support measures in response to the COVID-19

COVID-19 Monitor

To see the latest figures on the number of newly infected cases, deaths, number of tests and recoveries, please see the following COVID-19 dashboards:

COVID-19 Dynamics dashboard by Director General of Health Services (DGHS)

COVID-19 Dashboard for Bangladesh World Health Organization (WHO)

Trends of macro-economy, trade and investment

Despite the global economic downturn, Bangladeshi economy has been deemed relatively resilient to pandemic shocks, although the country’s trade and investment have experienced adverse impacts particularly during the initial stage of the COVID-19 pandemic. The latest observations on macro-economic performance, trades and investments are stated as below:

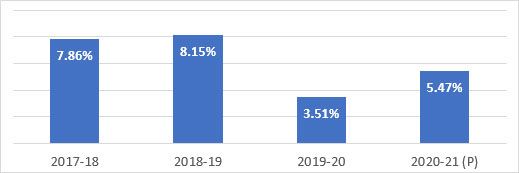

Gross Domestic Product (GDP) growth

Despite the global impacts by the COVID-19 pandemic and the consequent measures to restrict the people’s mobility through the nationwide lockdown, Bangladesh shows relative macro-economic resilience with estimated GDP growth of 5.5% in FY2020-21, followed by 3.5% in FY2019-20. Bangladesh was among the few economies of positive growth in 2020, and is ranked 40th resilient economies in the face of the COVID pandemic adversities, being the top among the South Asian nations (Bloomberg’s COVID Resilience Ranking on May 2021). According to the IMF, Bangladesh is forecasted to remain ahead of its neighbors in terms of per capita GDP in the next five years to 2026, while managing the difficult time of the post-COVID economic era.

Actual and forecasted real GDP growth rate

Source: Bangladesh Bureau of Statistics

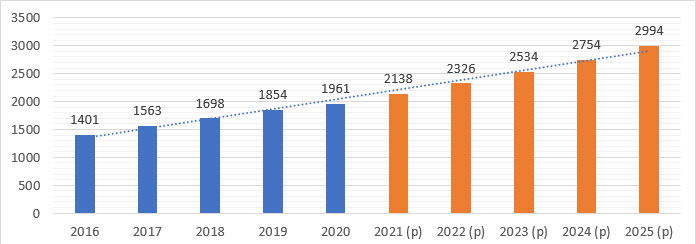

Actual and forecasted growth of GDP per capita (current USD)

Source: Bangladesh Bureau of Statistics, the World Bank Group/ IMF (for forecasts)

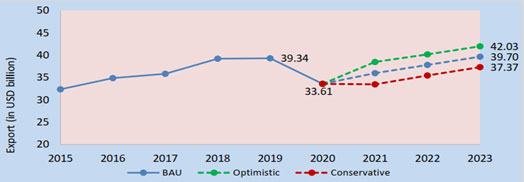

Trade performance

Export: The country’s export was significantly affected right after the COVID-19 outbreak, because of the global demand slump followed by rampant order suspension or cancellations of major export items, ready-made garment, and further deteriorated by the backlog in export shipping. Export also confronted material input constraint, arisen from the disruption of regional supply-chain. Destinations of the country’s major export items have been revitalizing from the beginning of 2021 onwards. Export which ended up to USD 33.6 billion in 2020 has recorded a 15% growth in 2021 and would reach USD 39.7 billion by 2023 under a business-as-usual (BAU) scenario, according to the Bangladesh Bank.

Export performance with forecasted scenario

Source: Bangladesh Bank

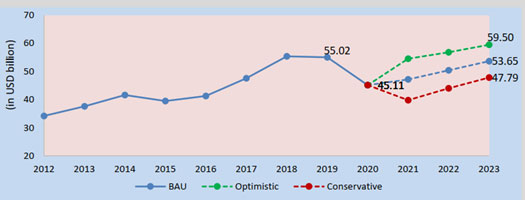

Import: The country’s import was also contracted during the initial stage of the COVID-19 pandemic in parallel with the downturn of export processing industries and because of material import disruption, stagnated construction works and consumer demand slump. Total import value declined particularly between Feb. and May 2020, but has later been showing the sign of recovery. According to a projection by the Bangladesh Bank, overall import value would recover to USD 53.7 billion in 2023 under a business-as-usual (BAU) scenario from the declined value recorded in 2020.

Import performance with forecasted scenario

Source: Bangladesh Bank

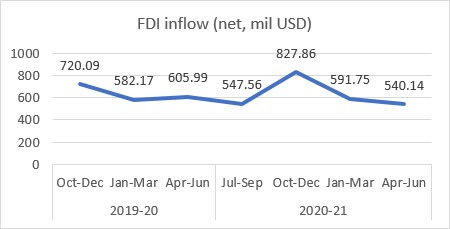

Foreign Direct Investment (FDI) inflow Compared to before the COVID-19 pandemic, FDI inflow (net) to Bangladesh has slightly declined. Throughout the pandemic period, however, FDI inflow volume (net, in quarterly basis) has been maintaining a range of USD 550 to 600 million. Even during the COVID-19 period, FDI inflow in the form of equity has doubled.

| Value of FDI inflow (net, in million USD) | ||

| SizeColorChest | Oct-Dec | 720.09 |

| Jan-Mar | 582.17 | |

| Apr-Jun | 605.99 | |

| WaistLengthFabricWarranty | Jul-Sep | 547.56 |

| Oct-Dec | 827.86 | |

| Jan-Mar | 591.75 | |

| 6 Months | 540.15 | |

Investment project registration with BIDA

The COVID-19 pandemic has adversely affected the new foreign project registration with BIDA. During the lock down period in Bangladesh (from Apr. to Jun. 2020), the number and value of new project registration was drastically declined but has been on the recovering trend since Oct.-Dec. 2020.

| New foreign project registration | |||

| Number | Value (in million USD) | ||

| FY 2019-20 | Oct-Dec | 60 | 1,325 |

| Jan-Mar | 47 | 268 | |

| Apr-Jun | 6 | 16 | |

| FY2020-21 | Jul-Sep | 19 | 113 |

| Oct-Dec | 30 | 687 | |

| Jan-Mar | 37 | 78 | |

| Apr-Jun | 16 | 19 | |

| FY2021-22 | Jul-Sep | 11 | 147 |

Policy support measures to businesses in response to the COVID-19

Since the beginning of the COVID-19 outbreak in the country, the Bangladesh government has undertaken various policy measures (including those related to credit/ interest rate, foreign exchange policies, and monetary/ liquidity easing) and announced financial stimulus packages for economic actors to mitigate their adverse impacts of the COVID-19 pandemic. Among these policy support measures, those currently available for private sector in the country are briefed as follow (as of December 2021):

Foreign exchange measures

The Bangladesh Bank has undertaken supporting measures to counteract adverse impacts of the COVID-19 on the external sector of Bangladesh, through the interventions in foreign exchange market, external trade and financial transactions.

Working capital facilities under the Stimulus Package

The Bangladeshi government has announced the financial Stimulus Package, which comprised of more than ten concessional working capital facilities for business purposes, in order to mitigate the adverse impacts of the COVID-19 pandemic on Bangladeshi economy and to safeguard their businesses from liquidity shocks. However, they are already expired as of December 2021.

Please see the following document, if interested in the financial-related measures (including Stimulus Package) that have been undertaken or announced so far by the Bangladesh Bank in response to the COVID-19 pandemic:

Policy measures of Bangladesh Bank in Response to the COVID-19 Pandemic (Special Publication), available through: www.bb.org.bd/en/index.php/publication/publictn/7/38