Chief Adviser's Office

Media Release

Transcript: 3rd State of Investment Climate - Bangladesh

May 08, 2025

The 3rd State of Investment Climate webinar hosted by Ashik Chowdhury, Executive Chairman of BIDA and BEZA on May 6 featured Sk. Bashir Uddin, Honorable Adviser, Ministry of Commerce, as Guest of Honor. This episode covered actions taken to improve the trade and investment environment.

Introduction

BIDA-BEZA EC: Welcome to the 3rd State of Investment Climate Bangladesh. My name is Ashik Chowdhury. I'm the Executive Chairman for Bangladesh Investment Development Authority and Bangladesh Economic Zones Authority, and I will be walking you through today's session. We have a very special guest with us today, our Commerce Advisor, who happens to be also a very successful businessman in his private life.

He's with us today, so we have a fantastic opportunity to ask tons of questions to him and hear from him. What has his experience been so far within the government? And what is he doing to improve the overall investment climate?

So, without further ado, I'm just going to jump into the session. We start with a small presentation about what has happened in the economy. What are we doing to improve the investment climate, and then finally, we'll go into Q&A with our special guest.

Before we do that, I really want to apologize for taking a bit longer to come up with the 3rd session or the 3rd version episode of this investment climate sessions, part of which was really driven by the fact that we were super busy with the investment summit that we hosted in Dhaka last month, and we're really looking forward to give you some updates on that as well.

Presentation

Download Presentation

So, let's start. Let's start our presentation straight away. As I said, it's divided into 3 parts. So, let's straight jump into the economic update.

FX Reserves and Exchange Rate

First up is obviously the forex reserve and the forex rate. As you have seen in recent times, our reserves have seen some improvement we have moved away from when we took over in August as interim government, a dip in the reserve on a regular basis. From there we are now seeing a turnaround. The Fx exchange rate has also stabilized. It is not showing another cliff edge drop, and that is also quite appeasing for our investors.

Behind this stability in Fx reserve, what we have also managed to do is pay down the arrears we had as governments. We paid over 3 billion dollars of arrears. So, if you think about it from a gross point of view, the Fx has really jumped up and it's driven by primarily two factors: One, the exports are up. It's fantastic news for us still driven by garments and textile industry. So, thanks to them. At the same time, the remittance from our foreign workers all over the world have actually jumped in massive numbers, as you can see in both the columns. The numbers are up all up in double digits, and the forecast we have so far that this trend is likely to continue.

Inflation

The other big question mark we had when we took over was the inflation. So, if you look at the inflation, and we've had a very steady, classic economist [Bangladesh Bank] governor, who was here last time when we did the second session for the investment climate, and he was very adamant that the policy rates need to dictate a contractionary monetary policy, and therefore eventually he believed that the interest rates are going to come down.

Once we have handled the inflation problem and looks like the inflation problem is slowly going away. So, as you can see, we took over at a position where it was in double digits. It's now already hit single digits, and it's showing a trend. Even the IMF report in very recent times says that by early next year we should see our inflation rate slightly around roughly about 5%, which is roughly our target. At that point we can also bring our policy rates down and hopefully galvanize investment even more.

Foreign Direct Investment

Now, behind all these, obviously, the classic question is, what has happened to FDI? The FDI overall for our country relative to our GDP has always been pretty poor, and we're not very proud of it. We need to change the narrative. If I look at the trend from last year to this year, the only good thing that I can say really is the fact that the FDI hasn't really fallen off the cliff. As you can see. There was a small blip during the 3rd quarter of last Year Calendar quarter that was driven by the fact that we had an unrest. Offices were closed and the country went through a transition.

But the final quarter of last year, we've already seen the FDI bouncing back to the normal levels that we have experienced in the last few years. The early news that we have for the 1st quarter of this year is pretty similar. So, the FDI number should not look very, very different from what you see today. All the work that we're doing now will hopefully result into FDI jumping up in the future. However, I do think that the private credit has not shown signs of full recovery. We are expecting March and April numbers to look much better than the numbers you see here, but that's something that is behind our minds, and I think part of it is obviously driven by the fact that we have fairly high policy rates which we intend to bring down as the inflation subsides.

Energy Security

So, these are some of the positive outcomes, or the positive news that we have. At the same time, I do want to acknowledge the challenges our investors and businesses are facing in country, so the primary one that I constantly have been hearing about is energy supply. The pricing strategy around the energy has not been the most customer friendly. From that point of view, we have gone through a period where once again, we had a massive level of arrears to the energy providers, and therefore some of these payables were being baked into the pricing. When we were buying energy from the global market, we were getting lesser and lesser number of interested parties who wanted to provide us with the energy, and therefore the quality was also being compromised. Now that we have paid down most of the arrears, we expect the pricing to come down and the supply of energy also to improve. And therefore within 3 to 6 months our expectation is this problem is going to go away.

Tariff

Obviously, the new tariff regime that has completely rattled the global trade landscape. We'll talk about it a lot more with our special guest, but that has created some level of unsettlement within our business community. At the end, I do think that we haven't necessarily managed to sort out all the problems at the grassroots level in terms of providing service to our customers. At the same time the pace of execution, the reforms that we are undertaking at this moment has not necessarily been as fast as we had anticipated, and part of which is obviously driven by the fact that we are learning as an interim government -- a government of technocrats -- how to run the government, and that learning process is evolving us into a better operator in this space.

Reform Progress Report

So, talking about the reforms and the investment climate improvements, let's look at the progress report. So, we've always said that in every SoIC-State of Investment Climate. We're going to come back to you and tell you, what have we done to improve the investment climate? How far are we from the goal that we had set ourselves at the beginning of the year. So, let's go to the Progress Report that we had set ourselves out for. So, the green ones are the ones that are completed. The red ones are the ones where we are slightly lagging behind, and obviously the yellow ones are in progress. I do want to touch upon a few of them. So, let's maybe jump into one of them. Let's look at the investment summit that we had planned to pull out, as you know.

Earlier in April, we held an Investment Summit. We had over 400 guests from about 40 countries who visited us, and the feedback was quite interesting. The reflections are, first of all, we probably need to do it consistently, and it can't just be a one-off exercise at the end of the day.

Bangladesh, if you look at Bangladesh from abroad, and if you just do a desktop search, it's always relatively negative from who we really are. We are not perfect, but we're not necessarily as bad as we look online. Therefore, it's important that we bring the investors here as often as we can. So, we need to repeat that messaging and make sure that we stay honest to our promises.

The second point was obviously the case, for Bangladesh has landed well, but we obviously need to prioritize the key reforms and the page you saw before where there was the list of reforms that we intend to exercise or finish by the end of this year.

The foreign investors did welcome the transparency. I don't know if all of you had joined the summit. But some of you who have, as you know, that we actually opened our doors up for the political parties, so we intend to pass on the power to political outfits, through a proper, free, and fair election ideally, by end of this year or by mid next year, and when we do that a big question mark always comes from the investors -- If the political outreach will continue down the same path as we are. And therefore, what we did was we actually did set up meeting rooms for the large political parties, and the investors could go and talk to them and understand what is their strategy around investment climate. So, we tried to keep a very open-door policy, and we tried to make sure that all the stakeholders within the ecosystem have an opportunity to talk to each other.

And finally, I do want to mention that it was a fantastic piece of teamwork, not only within the government agencies, but also a big chunk of this summit was actually organized and arranged by our private sector partners, the banks, the consultants, the corporations, the associations that have worked with us. Majority of the summit, in fact, was actually done by them. So, we are very happy and grateful for the support we got from the private sector.

Free trade zone

Another point that I do want to talk about is probably the port strategy that sits in the middle of our overall ambition. And what are we doing about it? We just came off from a meeting with our Commerce Adviser. Actually, it was about the free trade zone. So, we've just formed a national committee that is looking at the global best practices about free trade zone and case studies and working with some of the top global operators of free trade zone to understand how we can create something within our country, and they will be recommending appropriate legislative changes and potentially a location. And our goal is to achieve a significant milestone, a meaningful progress by the end of 2025. Another point that we had was about FDI outreach. We really wanted to democratize the FDI attraction job. And obviously, government doesn't have the right tools or the resources, and we will never have that, probably, but what we can do is to provide incentive programs to our colleagues, our friends, our families, all the non-resident Bangladeshis who live in different countries. So, we are trying to create an incentive scheme -- just like we promote the export or provide incentive for remittance. We're also setting up an incentive scheme for individuals who will be bringing FDI to Bangladesh. So please watch out the space for it. We will be announcing it very shortly.

The last piece that I probably want to talk about is the most talked about piece, which is the investor journey. As you know that a lot of times, we hear that the case for Bangladesh is there, but at the same time landing in Bangladesh is incredibly difficult, and therefore people just step back and shy away from investing in one of this. So, we've been looking at a relationship manager model for just like a banking model where you have relationship manager within Bangladesh Investment Development Authority, who walks you around. So, I'm very happy to announce that we've actually advertised the roles now in private sector. So, these are going to be private sector specialists working within the government for a couple of years as a secondment role and then working with the investors holding their hands across the different alleys within government offices. So, the advert is out. Hopefully, we will have them on board in a couple of months.

We've also decided that all the public services are is going are going to be under one umbrella. So essentially as an investor, you will walk into a single platform, and this behind the scenes. The government offices will provide the services. But we are bringing all these digital services under one umbrella, so that we have a clear view of who the customer is. At the same time the customer has a single landing point, after which the services can be provided by different government agencies, whenever needed. And then, finally, we have also formed a national committee who is looking at the Investment Promotion Agency integration project. So, as you probably know, depending on who you ask, we have between 5 to 7 investment promotion agencies which obviously confuses the entire investor pool where to start, who to go to? Who to talk to? And there has been an overcry from investors, actually from our friends in Japan, from friends in Korea, and from many other markets, that all these investment promotion agencies should be under one big umbrella. So, we are now looking at it through that National Committee: how we can integrate these investment promotion agencies, so that when the investor walks in, he or she actually sees just one investment promotion agencies, and that becomes the first point of contact for investors within the government of Bangladesh.

I'm not going to go further into these reform ideas. What I think I would love to do is to bring in our guest so that we can spend more time with him, and we can also take some of your questions.

Q&A

BIDA-BEZA EC: Thank you so much for joining us. By the way, if I maybe start with asking you a question that I had, which is, it's been a few months for you in the government and how has it been? How have you found your time in the Government? You are obviously responsible for one of the most crucial ministries, the Commerce Ministry along with a few other ministries. But what's your initial take on the trade space and the investment space for Bangladesh?

Commerce Adviser: Well, I as you, as you know, that I also come from private sector, from a family-owned business -- the business which my father founded over 80 years before. I was not expecting to come and work for the Government, but when I was asked, I joined the government with no experience of government affairs. We are this host of people who were handpicked by our chief adviser. Of course, it's a very, very interesting journey. Interesting because, the fascist who was ruling us for over 15 long years brought the economy into a very difficult state. From there, under the Chief Adviser’s leadership as you have reported, the macroeconomic stability, the current account and the financial account situations. It's a manifestation of a lot of good, hard work and collective work of all of us together. We together believe that success is a journey, it is not a destination. So, therefore, we have embarked on this very, very interesting and exciting journey. Accomplishing some of the very fine jobs that we are doing together.

BIDA-BEZA EC: Thank you. I'll go straight into the questions, and we've received over 100 questions. So, I apologize to a lot of our audience that we might not be able to cover all of them today. And we'll try to email answer them to you later, at some point in time. So maybe the first question which is on top of everyone's mind about the Trump tariff. Let's call it Trump tariff. Obviously, we have received a postponement. But tons of questions around. What are your thoughts? How do you see us dealing with it? Do you see this as a big challenge? And what do you think eventually this is going to turn out to be.

Commerce Adviser: I mean, you know, a lot of it is basically speculations and at the same time the reality as this was devoted on the trade deficits. So, we therefore have estimated and it's a very clear calculation and we have mapped a group of products and a roadmap by which we would substantially reduce our trade gaps and thereby sustain the tariff regime that we used to trade with. Ideally, we as an LDC country -- under the WTO Framework, is supposed to work on an MFN (Most-Favored-Nation) target basis. We believe we wish to sustain that. And we are making material contributions or material trade trends by liberalizing our trade by removing non-tariff monetary barriers and identifying products which would enable us to reduce substantially the trade gaps, and hoping that we would sustain our MFN tariff status.

BIDA-BEZA EC: Thank you. There's a question around the transshipment piece. You've done a lot of work with that in recent times, as we understand lot of interest about that. This overall logistics space. The whole transshipment point that became a big topic has kind of died down. Now what are your thoughts around it? What is Bangladesh Government trying to do to improve the overall logistical space on trade?

Commerce Adviser: Are you referring to the air transshipment issues or the sea transshipment issues? If it is air -- we have leveraged all our hidden treasures. As you know, now I am also responsible for the civil aviation ministry, and then we have started one new airport for freighter cargoes. Our target is not only to match the prices, the price differentials for the transshipments was that the transshipment providing country was cheaper than us. As a source country, and my target is not only to meet that cost, but also to offset that. And then I have reasons to believe. In few weeks, time from now we will become much more efficient and, much more cost competitive. You also know that we have invested into a new cargo terminal, together with a new airport terminal. So, and where we have automated state-of-the-art facilities with cutting edge technology to minimize the turnaround time for the air freighters especially. I'm sure we'll find our excellence and be able to meet the cost expectations as well, and very soon. I'm talking weeks.

BIDA-BEZA EC: Fantastic. And I mean, I'm guessing just from your point of view, the we always talk about when we talk about air. We always talk about. Tucker is this, are we talking about Tucker only? Are we talking about a wider network of.

Commerce Adviser: We have a few more airports to leverage. Dhaka, Sylhet, Chittagong -- potentially, also Cox's Bazaar, where we are making our runway long enough to accommodate 74- 7-800 aircraft to take the highest amount of payload. So yes, we are thinking beyond Dhaka, for sure.

BIDA-BEZA EC: Thank you. And a related question that I see on the screen, and maybe I'll just ask it straight away, which is related to the same ministry that we just spoke about. So, taking the new lead as advisor for the Ministry of Civil Aviation and Tourism. How does he envision to encourage investment either local or foreign, in this space.

Commerce Adviser: Are you referring Civil Aviation? Of course I mean, we I have just approved one new aircraft for one of the domestic airlines, and I am inviting additional foreign carriers to come up with the freighters. I am going to liberalize the existing regulations to kickstart a lot of new freighters, so I hope there'll be a lot more inclusion soon.

BIDA-BEZA EC: Fantastic. And what about tourism?

Commerce Adviser: Tourism, I think, given the historic and the cultural context, I think I need to work first for the domestic tourist. As you know, that we are more than 180 million people in the country, and there are, quite a large affluent class who wish to go and explore and enjoy the domestic tourist spots, and I think reasonable investment is necessary for this. So, I would call for people -- whoever are interested to come and invest in that sector.

BIDA-BEZA EC: Thank you. Just shifting gears to a different sector. So, what is the government's vision for strengthening digital trade and e-commerce sector. Is there any plan or view about those sectors, and particularly while ensuring consumer rights and preventing fraud?

Commerce Adviser: Our central bank is working to enable the e-commerce gateways. There is a committee who is working for it and we are looking forward to the report. We wish to have all those international gateways active as soon as possible. Therefore, this and logistics and all other issues around it should work together. I'm yet to see that report. But I can't tell you more than what I have said at this point of time.

BIDA-BEZA EC: No problem. Thank you. I'll go back to a question that was asked earlier yesterday. Actually, how is the ministry addressing high cost of logistics to improve supply chain efficiency? Given our significant post-harvest losses that we see by the farmers every year for a supply demand mismatch.

Commerce Adviser: We certainly need to increase our efficiency and thereby reduce the cost and this requires heavy investment into our road networks into our traffic system, into our cost of fuel, and also the logistics machines, which are buses trucks, whatever around it. I think it's an ongoing process. As you have seen, we have been developing very nice road network within the country. We also have facilitated local productions of commercial vehicles, thereby also reducing the cost of ownership of those commercial vehicles for international logistic. I think we are also working to improve capacity of our terminals. I'm sure you personally are working very actively on that and also our deep-sea port should come in function soon enough. So, all this combined, I think our going forward, our cost is going to get down substantially.

BIDA-BEZA EC: Thank you. Again, switching gears. So, I'm just reading through some of the questions. This is a this is a very interesting one. So, as we know that the first impression is the best impression and investors, foreigners usually face a lot of hassle at our airports. What can you do about this?

Commerce Adviser: As you know, that we are going to. Hopefully, by the end of the year we're going to open the new terminal and we are working with a very well reputed one of the Fortune 500 companies to come and operate our airport to give that world class experience to all the incoming visitors. I hope once that is in place by the end of the year. This impression is going to change once and forever.

BIDA-BEZA EC: I will move on to another question related to your jute and textile portfolio. We haven't really touched that. These are quite specialized industries, and not necessarily all the countries have a jute and textile ministry. It's quite unique for us to have it. What you have seen so far, what are your thoughts about these two industries? And obviously, government plays a very active role in these industries. What's your long-term vision about that.

Commerce Adviser: Government owned approximately 32 companies, and about similar numbers, textile companies which all have ceased to operate. So, government is trying to lease them out to private sectors for very, very long term the minimum lease tenure is about 30 years with about 3 years rent free period for the investors to come. And you know, do the initial preparations in terms of the private sector support for textile, which is a very key industry for Bangladesh. So, we work on our textile policies and all the facilitations to enable backward integrations for our apparel industry. So, there is a host of policies to support and to incentivize our industry, and to sustain them, and to let them grow. So, from the textile and jute ministries fundamentally to take care of this large, about 60 factories that we have on a very, very nice locations and to lease them out, and at the same time to sustain and promote the privately-owned jute and textile is what the Jute and Textile Ministry is doing.

BIDA-BEZA EC: Next question, is there any plan regarding business and trade associations to reform? And specifically, I think, the individual who's asking the question is also concerned about how SMEs usually get left out in these associations.

Commerce Adviser: We have drafted the necessary reforms by consulting with all the stakeholders. This is actually now at the Ministry of Law for vetting. And we are expecting this to become a law very soon. Then we are going to conduct and further democratize and find the appropriate representations of the trade bodies, so that they can come and appropriately negotiate with government and can place their demands properly and promote the interest of the trade and commerce.

BIDA-BEZA EC: Are there highlights that you can pre-share to the audience like, what kind of changes could they expect from the new format?

Commerce Adviser: I can only tell you in the broad line, since it's under vetting now. So, I can't go to the specifics. But I can say the ultimate target is to find out appropriate representation and effective committee structure. So, we are doing some structural changes and to have democratic representations -- so fundamentally these. Whatever was there earlier, there was a lot of nominated members from the vested groups -- and even in the apex trade bodies, and all the associations that we have. So, we have talked with all the stakeholders, like I said before, and then we have formulated a policy which I think would really facilitate the interest of the trade bodies.

BIDA-BEZA EC: Thank you. Next question. So, what's your plan to reduce the post-harvest loss, particularly for perishable goods, and the same time to improve the cold chain system in the country.

Commerce Adviser: Well, that is a very sad situation that we have, as you know, that with large populations we need a lot of food. The value of our entire food basket in our countries is over USD 150 billion. And we still import quite a bit of our cereal needs. And also, fruits and vegetables. At the same time, we have a lot of post-harvest decompositions or waste. So, we need to build buffers with appropriate capability to sustain the quality of those food and vegetables. The private sector has invested quite heavily in cold storages. So, if you look at potatoes, I think we can more or less store about 4 million tons of potatoes when we need, when the country for the year round needs about 8 to 9 million tons of potatoes. So, which I believe, is reasonably okay unless you have a bumper crop in some years, once in 10 years. But other than that, things like chili onions and other spices - I think we need to build capacity. And people are building capacity. We as government, we are also thinking of building certain capacity. We are building capacity at our core facility now for all the imported goods. This is going to help us save on logistics cost, because a lot of these refrigerated containers, which has to go ultimately until the destinations and thereby increasing the cost. So, we are now saying that we would like to build an intermediate buffer storage system at our port level. So yes, we are, investing in this infrastructure. But we need investment also, local and foreign, and also by the governments to serve the need of the people.

BIDA-BEZA EC: Thank you. Are you engaging with the civil society and the private sector in shaping your trade policies?

Commerce Adviser: Of course we are. I mean, without this we cannot move forward. I mean, we need to learn from all the stakeholders and make those changes and adopt those policies which will facilitate increase of trade. That's my core responsibility - to have more trade inclusions to diversify my trade and to expand my trade. So, I do talk quite frequently with the stakeholders.

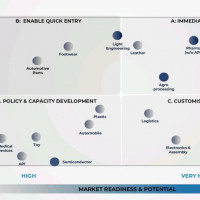

BIDA-BEZA EC: Great. The diversification point came up as well in the questions. What do you think we should be doing as a government to diversify our export basket. It has been talked about for decades but we've never managed to crack it. How do we do it? And are you already on a track of making it happen?

Commerce Adviser: I think if you're referring to export diversifications or internal trade diversification. So of course, it is easier said than done, because we, you know that we have a workforce of 140 million in our country, which can easily be leveraged, and beyond April, we are yet to see some scale of operations, which is, absolutely necessary. It has to be a collective work of many government’s wings, and then embark on this journey, and then find those facilitators and achieve this. Of course, we have. We need to identify a few products that would enable us and create the employment and generate that revenue to make it sustainable for us.

BIDA-BEZA EC: So maybe I'll ask two more questions. First up, we have heard in recent times, and I think, number of questions on that line, which is, we've had challenges with the supply of energy as businesses. I'm sure you've also heard about that from business community. What is what is Government's initiative in solving that challenge that all the businesses are facing at this moment related to gas supply and electricity supply?

Commerce Adviser: We have primarily two sources of energy. One is by the grid and the other one is the captive energy that you generate by natural gas. We have a very nice pipe network within the country to distribute gas, but sadly, we do not have enough regasification stations. We have only one, and there also we have some spare capacity which we wish to now fill up. We have some indigenous gas, I don't have the precise number, but about 50% of our gas is indigenous, and probably 40 or 50% is imported. I think our Ministry of Energy is building new FSRU stations, which will then bring more liquefied natural gas and then re-gasify and distribute it through the pipe network. The captive power generation is economically more competitive compared to buying it from the grid. So, it's cheaper and quality wise also better. In many industries, it serves their core generation needs, by which it becomes even more competitive. So, going forward, I see this, we have challenges. Of course, we need to recognize that. But going forward once the LNGs are brought in into the country, and with the necessary infrastructure behind it to re-gasify. We hope that we can solve problem. We have one region in the country, which is gas surplus. So, any potential investors can come and immediately get natural gas connections. You know, Bhola -- wherein you can go and build your factory without any problem, and if you generate your own electricity by gas generators, it is cheaper, better quality, wise, higher. That should solve your problem as well.

BIDA-BEZA EC: Thank you. So last question is actually my question. I'm taking this as an answer that I can probably use in future. So, if you were to pitch to invest in Bangladesh, how would you pitch it?

Commerce Adviser: Please invest. This is a great place to invest, because all that you have explained in your [EC] opening remarks. And functionally, we work together. You know that we work very, very closely. We interact, we learn from each other, and then we function accordingly. And I think that the benchmark that we are building for successes are going to be nice. As you have also brought into your investor summit those large political parties who potentially are going to be our political masters, they have also explained their positions quite clearly. So, I mean, we have trainable workforces. We have landmass necessary for productions. Our people need jobs. They are generally very friendly to foreign investors. Even if they're tourists, or whatever you will see. Bangladeshi people are generally very, very friendly and no foreigners are ever in risk in Bangladesh, I mean, history proves that very, very clearly. So, I think we have mutual benefits in investing in Bangladesh. Bangladesh benefits, and I think the investor would also benefit. If you see the success stories of all the investment that whoever have done it. They are taking the dividends, come and share it. So, this is what I would say.

BIDA-BEZA EC: Thank you. Well, you have successfully been part of a business conglomerate, and actually also sold your business to a foreign investor. So that itself is an example for people to follow. Thank you so much for coming. We've literally ran through for more than 35 minutes now into the Q&A. So, ladies and gentlemen, thanks again for joining us, and we will hopefully see you in a month's time coming back again and hopefully, with a new guest. Next time, thanks again to the Honorable Commerce Adviser.

Commerce Adviser: Thank you and all the best.